The page you requested cannot be found.The page you are looking for might have been removed, had its name changed, or is temporarily unavailable.

If you are trying to reach a page from a bookmark, the page URL may have changed recently.

Please try the following:

- Open Our Home Page

- Click the back button to in your browser to return to the previous page.

- Enter a term in the search form below.

Search results for ""

April 28 - Rebuilding the Foundations: Warning: Construction Area

“These I will bring to my holy mountain, and make them joyful in my house of prayer; their burnt offerings and their sacrifices will be accepted on my altar; for my house shall be called a house of prayer for all peoples.” (Isaiah 56:7)

Rebuilding the Foundations: Warning: Construction Area

Rev. Christopher A. Henry

Senior Pastor

April 28, 2024April 21 - Rebuilding the Foundations: The Art of Neighboring

"For surely I know the plans I have for you, says the Lord, plans for your welfare and not for harm, to give you a future with hope."

(Jeremiah 29:11)Rebuilding the Foundations: The Art of Neighboring

Rev. Christopher A. Henry

Senior Pastor

April 21, 2024April 14 - Remembering Our Way Our of Exile

“Have you not known? Have you not heard?”

(Isaiah 40:28)

Rebuilding the Foundations: Remembering Our Way Our of Exile

Rev. Christopher A. Henry

Senior Pastor

April 14, 2024April 7 - Easter Living

“A week later his disciples were again in the house, and Thomas was with them. Although the doors were shut, Jesus came and stood among them and said, ‘Peace be with you.’”

(John 20:26)Easter Living

Rev. Madison M. VanVeelen

Associate Pastor of Care

April 7, 2024Home Again

Rev. Christopher A. Henry

Senior Pastor

March 31, 2024March 24 - The Donkey is the Point

“Jesus found a young donkey and sat on it...”

(John 12:14)Braving the Wilderness: The Donkey is the Point

Rev. Christopher A. Henry

Senior Pastor

March 24, 2024

March 17 - A River in the Desert

"Thus says the Lord, who makes a way in the sea, a path in the mighty waters..."

(Isaiah 43:16)March 10 - The Wild Within

"Then Jacob woke from his sleep and said, 'Surely the Lord is in this place—and I did not know it!'"

(Genesis 28:16)Braving the Wilderness: A River in the Desert

Rev. Christopher A. Henry

Senior Pastor

March 17, 2024Braving the Wilderness: The Wild Within

Rev. Christopher A. Henry

Senior Pastor

March 10, 2024March 03 - The Threat of Life

"He said to them, 'Why are you afraid? Have you still no faith?'"

(Mark 4:40)Braving the Wilderness: The Threat of Life

Rev. Christopher A. Henry

Senior Pastor

March 3, 2024February 25 - Is the Lord Among Us?

"He called the place Massah and Meribah, because the Israelites quarreled and tested the Lord, saying, 'Is the Lord among us or not?'"

(Exodus 17:7)February 18 - Lost and Found

"He was in the wilderness forty days, tempted by Satan;

and he was with the wild beasts; and the angels waited on him."

(Mark 1:13)Braving the Wilderness: Is the Lord Among Us?

Rev. Christopher A. Henry

Senior Pastor

February 25, 2024Braving the Wilderness: Lost and Found

Rev. Christopher A. Henry

Senior Pastor

February 18, 2024February 11 - Resurrection and the Life

"Jesus said to her, 'I am the resurrection and the life. Those who believe in me, even though they die, will live, and everyone who lives and believes in me will never die. Do you believe this?'"

(John 11:25-26)I Am: Building a Christ-Centered Church: Resurrection and the Life

Rev. Christopher A. Henry

Senior Pastor

February 11, 2024February 04 - Light of the World

"Again Jesus spoke to them, saying, ‘I am the light of the world. Whoever follows me will never walk in darkness but will have the light of life.'"

(John 8:12)I Am: Building a Christ-Centered Church: Light of the World

Rev. Christopher A. Henry

Senior Pastor

February 4, 2024January 28 - Good Shepherd

"I am the good shepherd. The good shepherd lays down his life for the sheep."

(John 10:11)I Am: Building a Christ-Centered Church: Good Shepherd

Rev. Christopher A. Henry

Senior Pastor

January 28, 2024January 21 - Way, Truth, Life

Jesus said to him, ‘I am the way, and the truth, and the life.

No one comes to the Father except through me.’”

(John 14:6)

I Am: Building a Christ-Centered Church: Way, Truth, Life

Rev. Christopher A. Henry

Senior Pastor

January 21, 2024January 14 - Bread of Life

“Jesus said to them, ‘I am the bread of life.

Whoever comes to me will never be hungry, and whoever believes in me will never be thirsty.’”

(John 6:35)

I Am: Building a Christ-Centered Church: Bread of Life

Rev. Christopher A. Henry

Senior Pastor

January 14, 2024January 07 - Rising and Shining

The light shines in the darkness, and the darkness did not overcome it.

(John 1:5)

Christmas in the Gospels: John's Vision

Rev. Christopher A. Henry

Senior Pastor

December 24, 2023Rising and Shining

Rev. Christopher A. Henry

Senior Pastor

January 7, 2024December 31 - The Beginning Word

The light shines in the darkness, and the darkness did not overcome it.

(John 1:5)

The Beginning Word

Rev. Michael M. Samson

Associate Pastor for Engagement

December 31, 2023December 17 - Luke's Song

Luke’s Song

“And Mary said, ‘My soul magnifies the Lord...’”

(Luke 1:46)

Christmas in the Gospels: Luke's Song

Rev. Christopher A. Henry

Senior Pastor

December 17, 2023December 10 - Matthew's Family Tree

“But just when he had resolved to do this, an angel of the Lord appeared

to him in a dream and said, ‘Joseph, son of David, do not be afraid to take Mary as your wife,

for the child conceived in her is from the Holy Spirit.’”

(Matthew 1:20)

Christmas in the Gospels: Matthew's Family Tree

Rev. Christopher A. Henry

Senior Pastor

December 10, 2023December 03 - Mark's Messenger

“The beginning of the good news of Jesus Christ, the Son of God.”

(Mark 1:1)

Christmas in the Gospels: Mark's Messenger

Rev. Christopher A. Henry

Senior Pastor

December 3, 2023November 26 - In God's Hands

“But seek first the kingdom of God and his righteousness,

and all these things will be given to you as well.”

(Matthew 6:33)

In God's Hands

Rev. Gracie H. Payne

Director of Young Adult Engagement

November 26, 2023November 19 - The Most Precious Gifts

“Jesus said to him, ‘If you wish to be perfect, go, sell your possessions,

and give the money to the poor, and you will have treasure in heaven; then come, follow me.’”

(Matthew 19:21)

In Our Hands: The Most Precious Gifts

Rev. Christopher A. Henry

Senior Pastor

November 19, 2023November 12 - When Time is Short

”Then Joseph said to his brothers, ‘I am about to die; but God will surely come to you,

and bring you up out of this land to the land that he swore to Abraham, to Isaac, and to Jacob.’”

(Genesis 50:24)

In Our Hands: When Time is Short

Rev. Christopher A. Henry

Senior Pastor

November 12, 2023November 05 - Stay in Your Lane

“The greatest among you will be your servant. All who exalt themselves will be humbled,

and all who humble themselves will be exalted.”

(Matthew 23:11-12)

October 29 - Redeem the Time

“...making the most of the time, because the days are evil.”

(Ephesians 5:15-20)

Redeem the Time

Rev. Christopher A. Henry

Senior Pastor

October 29, 2023What Faith Asks of Us: Practice the Pause

Rev. Christopher A. Henry

Senior Pastor

October 22, 2023October 22 - Practice the Pause

“Come to me, all you that are weary and are carrying heavy burdens, and I will give you rest.”

(Matthew 11:28)

October 15 - Don't delay Joy

“Rejoice always, pray without ceasing, give thanks in all circumstances;

for this is the will of God in Christ Jesus for you.”

(1 Thessalonians 5:16-18)

What Faith Asks of Us: Don't Delay Joy

Rev. Christopher A. Henry

Senior Pastor

October 15, 2023October 8 - Engaged Minds

“He said to him, ‘You shall love the Lord your God with all your heart,

and with all your soul, and with all your mind.’ “

(Matthew 22:34-40)

What Faith Asks of Us: Engaged Minds

Rev. Christopher A. Henry

Senior Pastor

October 8, 2023October 1 - The Grace to Receive

“When the Israelites saw it, they said to one another, “What is it?” For they did not know what it was.

Moses said to them, “It is the bread that the Lord has given you to eat.”

(Exodus 16:15)

What Faith Asks of Us: The Grace to Receive

Rev. Christopher A. Henry

Senior Pastor

October 1, 2023What Faith Asks of Us: Let's Be Real

Rev. Christopher A. Henry

Senior Pastor

September 24, 2023September 24 - Let's Be Real

“Why do you pass judgment on your brother or sister? Or you, why do you despise your brother or sister?

For we will all stand before the judgment seat of God.”

(Romans 14:10)

What Faith Asks of Us: Molded Creatures

Rev. Christopher A. Henry

Senior Pastor

September 17, 2023September 17 - Molded Creatures

“Can I not do with you, O house of Israel, just as this potter has done? says the Lord.

Just like the clay in the potter’s hand, so are you in my hand, O house of Israel.”

(Jeremiah 18:6)

September 10 - A Time to Rebuild

Your ancient ruins shall be rebuilt; you shall raise up the foundations of many generations; you shall be called the repairer of the breach, the restorer of streets to live in.

(Isaiah 58:12)

A Time to Rebuild

Rev. Christopher A. Henry

Senior Pastor

September 10, 2023September 03 - Whispers From God

“ ...and after the earthquake a fire, but the Lord was not in the fire,

and after the fire a sound of sheer silence.”

(1 Kings 19:12)

Calm and Quiet: Whispers from God

Tom Markey

Interim Director of Youth Ministries

September 3, 2023August 27 - Are the Kids Alright?

Let no one despise your youth, but set the believers an example

in speech and conduct, in love, in faith, in purity.

(1 Timothy 4:12)

I Wish the Preacher Would Talk About: Are the Kids Alright?

Rev. Christopher A. Henry

Senior Pastor

August 27, 2023August 20 - Politics in Church

Those who find their life will lose it, and those who lose their life for my sake will find it.

(Matthew 10:39)

I Wish the Preacher Would Talk About: Politics in Church

Rev. Christopher A. Henry

Senior Pastor

August 20, 2023August 13 - How Much is Enough?

And he said to them, “Take care! Be on your guard against all kinds of greed; for one’s life does not consist in the abundance of possessions.”

(Luke 12:15)

I Wish the Preacher Would Talk About: How Much is Enough?

Rev. Christopher A. Henry

Senior Pastor

August 13, 2023August 06 - What is Predestination?

We know that all things work together for good for those who love God, who are called according to his purpose.

(Romans 8:28)

I Wish the Preacher Would Talk About: What is Predestination?

Rev. Christopher A. Henry

Senior Pastor

August 6, 2023July 30 - Back to the Beginning

He is the image of the invisible God, the firstborn of all creation.

(Colossians 1:15)

Scripture's Greatest Hits: Back to the Beginning

Rev. Sara Dorrien-Christians

Associate Pastor for Children and Family Ministries

July 30, 2023Scripture's Greatest Hits: It's All About Love

Rev. Christopher A. Henry

Senior Pastor

July 23, 2023Scripture's Greatest Hits: Jesus' Mission Statement

Rev. Christopher A. Henry

Senior Pastor

July 16, 2023July 23 - It's All About Love

And now faith, hope, and love abide, these three; and the greatest of these is love.”

(1 Corinthians 13:13)

July 16 - Jesus' Mission Statement

Then he began to say to them, “Today this scripture has been fulfilled in your hearing.”

(Luke 4:21)

July 09 - The Yoke of Christ

Come to me, all you that are weary and carrying heavy burdens, and I will give you rest.

(Matthew 11:28)

Scripture's Greatest Hits: The Yoke of Christ

Rev. Madison M. VanVeelen

Associate Pastor of Care

July 09, 2023July 02 - Can These Bones Live?

He said to me, “Mortal, can these bones live?” I answered, “O Lord God, you know.”

(Ezekiel 37:3)

Scripture's Greatest Hits: Can These Bones Live?

Rev. Christopher A. Henry

Senior Pastor

July 02, 2023Scripture's Greatest Hits: Listening For God

Rev. Christopher A. Henry

Senior Pastor

June 25, 2023June 25 - Listening For God

Now the Lord came and stood there, calling as before, “Samuel! Samuel!” And Samuel said, “Speak, for your servant is listening.”

(1 Samuel 3:1-10)

June 18 - Family Matters

But Ruth said, “Do not press me to leave you or to turn back from following you! Where you go, I will go; Where you lodge, I will lodge; your people shall be my people, and your God my God.”

(Ruth 1:16)

Scripture's Greatest Hits: Family Matters

Rev. Christopher A. Henry

Senior Pastor

June 18, 2023June 11 - God's Saying It Makes It So

Then God said, “Let there be light”; and there was light.

(Genesis 1:3)

Scripture's Greatest Hits: God's Saying It Makes It So

Rev. Karen L. Lang

Executive Pastor

June 11, 2023A Joyful Call

Rev. Tyler D. Brinks

Lake Fellow in Parish Ministry

June 4, 2023June 04 - A Joyful Call

"Go therefore and make disciples of all nations, baptizing them in the name of the Father and of the Son and of the Holy Spirit.”

(Matthew 28:19)

May 28 - A Living Church

But the Advocate, the Holy Spirit, whom the Father will send in my name, will teach you everything, and remind you of all that I have said to you.

(John 14:26)A Living Church

Rev. Christopher A. Henry

Senior Pastor

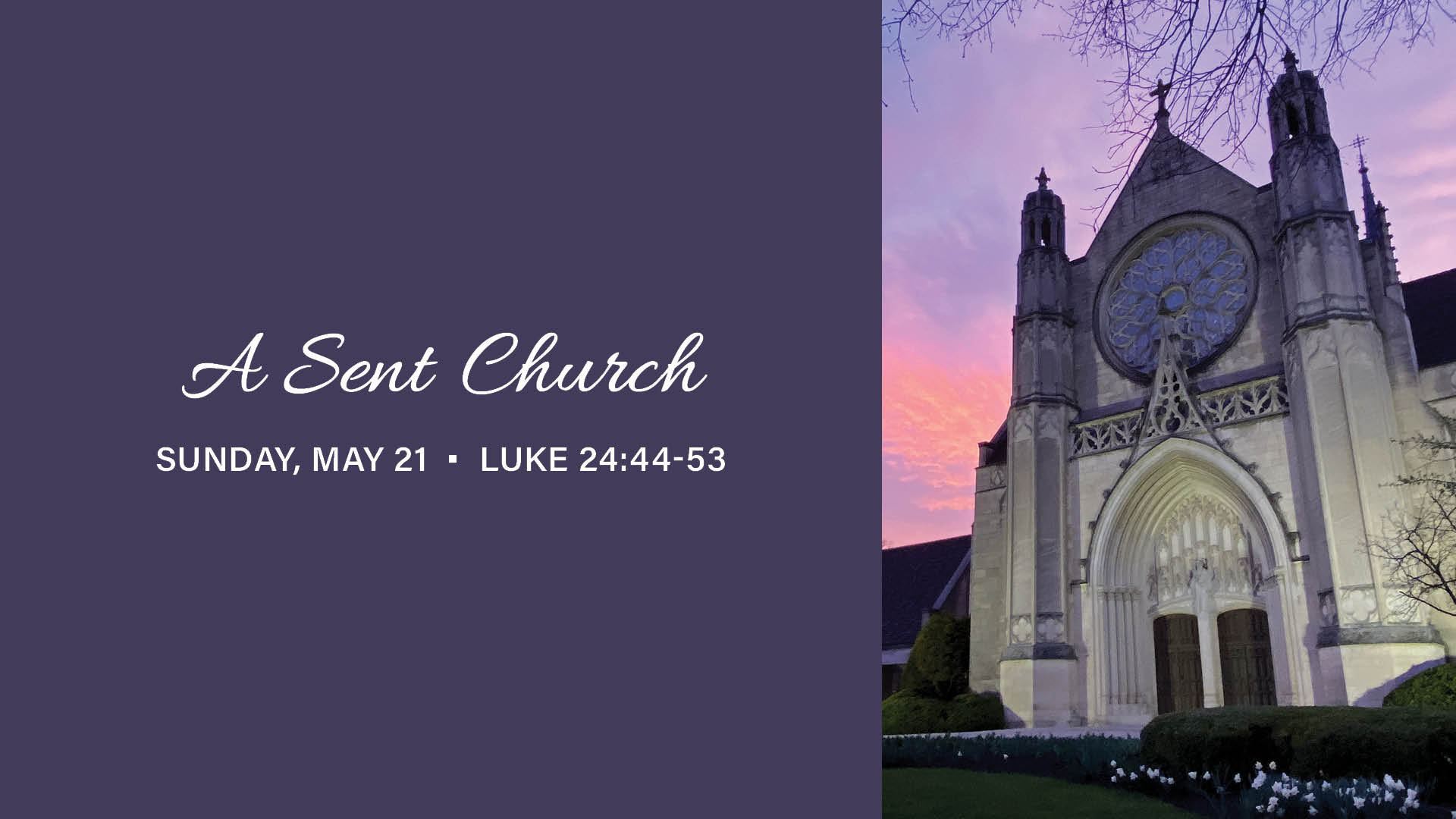

May 28, 2023May 21 - A Sent Church

A Sent Church

You are witnesses of these things. And see, I am sending upon you what my Father promised;

so stay here in the city until you have been clothed with power from on high.

(Luke 24:48-49)A Sent Church

Rev. Christopher A. Henry

Senior Pastor

May 21, 2023May 14 - A Gathered Church

“A Gathered Church”

“So then you are no longer strangers and aliens, but you are citizens with the saints

and also members of the household of God. ” (Ephesians 2:19)A Gathered Church

Rev. Christopher A. Henry

Senior Pastor

May 14, 2023Faith in Action: Pray and Move Your Feet

Rev. Christopher A. Henry

Senior Pastor

May 07, 2023May 07 - Pray and Move Your Feet

“Pray and Move Your Feet”

“The prayer of the righteous is powerful and effective. “ (James 5:16)April 30 - A Way to Serve

“A Way to Serve”

“So faith by itself, if it has no works, is dead. “ (James 2:17)Faith in Action: A Way to Serve

Rev. Christopher A. Henry

Senior Pastor

April 30, 2023April 23 - Listen First

“Listen First”

“You must understand this, my beloved: let everyone be quick to listen, slow to speak, slow to anger, ...”

(James 1:19)Faith in Action: Listen First

Rev. Christopher A. Henry

Senior Pastor

April 23, 2023April 16 - Unless I See

“Unless I See”

So the other disciples told him, “We have seen the Lord.” But he said to them, “Unless I see the mark

of the nails in his hands and put my finger in the mark of the nails and my hand in his side, I will not

believe.” (John 20:19-31)Unless I See

Rev. Michael M. Samson

Associate Pastor for Engagement

April 16, 2023April 09 - Joy in the Morning

“Joy in the Morning”

"But on the first day of the week, at early dawn, they came to the tomb,

taking the spices that they had prepared."

(Luke 24:1)Easter Sunday: Joy in the Morning

Rev. Christopher A. Henry

Senior Pastor

April 9, 2023April 02 - Character and Virtue: Humility

“Humility”

"Tell the daughter of Zion, Look, your king is coming to you, humble, and mounted on a donkey, and on a colt, the foal of a donkey."

(Matthew 21:5)Character and Virtue: Humility

Rev. Christopher A. Henry

Senior Pastor

April 2, 2023March 26 - Character and Virtue: Courage

“I hereby command you: Be strong and courageous; do not be frightened or dismayed, for the Lord your God is with you wherever you go.”

(Joshua 1:1-9)Character and Virtue: Courage

Rev. Christopher A. Henry

Senior Pastor

March 26, 2023March 19 - Character and Virtue: Hope

“Hope”

“Endurance produces character, and character produces hope, and hope does not disappoint us.”

(Romans 5:4-5)March 12 - Character and Virtue: Friendship

“Friendship”

“You are my friends if you do what I command you.” (John 15:14)Character and Virtue: Hope

Rev. Christopher A. Henry

Senior Pastor

March 19, 2023Character and Virtue: Friendship

Rev. Christopher A. Henry

Senior Pastor

March 12, 2023Character and Virtue: Truthfulness

Rev. Christopher A. Henry

Senior Pastor

March 05, 2023March 05 - Character and Virtue: Truthfulness

“Truthfulness”

“They all deceive their neighbors, and no one speaks the truth; they have taught their tongues to speak lies; they commit iniquity and are too weary to repent.” (Jeremiah 9:5)Ash Wednesday

Rev. Christopher A. Henry

Senior Pastor

February 22, 2023Character and Virtue: Kindness

Rev. Christopher A. Henry

Senior Pastor

February 26, 2023Can We Be Transformed

Rev. Gracie H. Payne

Director of Young Adult Engagement

February 19, 2023February 26 - Character and Virtue: Kindness

“Kindness”

“As God’s chosen ones, holy and beloved, clothe yourselves with compassion, kindness,

humility, meekness, and patience.” (Colossians 3:12)February 19 - Can We Be Transformed?

“Can We Be Transformed?”

“Suddenly a bright cloud overshadowed them, and a voice from the cloud said,

‘This is my Son, the Beloved; with him I am well pleased; listen to him!’” (Matthew 17:5)Whose Justice?

Rev. Christopher A. Henry

Senior Pastor

February 12, 2023February 12 - Whose Justice?

“Whose Justice?”

“So the last will be first, and the first will be last.” (Matthew 20:16)The Problem with Piety

Rev. Christopher A. Henry

Senior Pastor

February 05, 2023Bothering God

Rev. Christopher A. Henry

Senior Pastor

January 29, 2023February 05 - The Problem with Piety

“The Problem with Piety”

“...for all who exalt themselves will be humbled, but all who humble themselves will be exalted.”

(Luke 18:14)January 29 - Bothering God

"Bothering God"

"Then Jesus told them a parable about their need to pray always and not to lose heart." (Luke 18:1)Lost and Found

Rev. Christopher A. Henry

Senior Pastor

January 22, 2023January 22 - Lost and Found

“Lost and Found”

“Rejoice with me, for I have found my sheep that was lost.”

(Luke 15:6)A Crowded Table

Rev. Christopher A. Henry

Senior Pastor

January 15, 2023Change of Plans

Rev. Karen Lang

Executive Pastor

January 01, 2023January 15 - A Crowded Table

“Then the master said to the slave, ‘Go out into the roads and lanes, and compel people to come in, so that my house may be filled.’”

(Luke 14:23)No Longer At Ease

Rev. Christopher A. Henry

Senior Pastor

January 08, 2023January 01 - Change of Plans

“When Joseph heard that Archelaus was ruling over Judea in place of his father Herod, He was afraid to go there. And after being warned in a dream, Joseph went away to the district of Galilee.”

(Matthew 2:22)Live in the Light

Rev. Christopher A. Henry

Senior Pastor

December 25, 2022December 25 - Live in the Light

“Live in the Light”

“The light shines in the darkness, and the darkness did not overcome it.”

(John 1:5)December 18 - Gentle Gratitude

“Gentle Gratitude”

“When Joseph awoke from sleep, he did as the angel of the Lord commanded him;

he took her as his wife.”

(Matthew 1:24)December 11 - Joyful Anticipation

“Joyful Anticipation”

“The angel said to her, “Do not be afraid, Mary, for you have found favor with God.”

(Luke 1:30)December 04 - Persistent Preparation

“Persistent Preparation”

“The beginning of the good news of Jesus Christ, the Son of God.”

(Mark 1:1)November 27 - Impatient Expectation

“Impatient Expectation”

“Yet, O Lord, you are our Father; we are the clay, and you are our potter;

we are all the work of your hand.”

(Isaiah 64:8)November 20 - The Reign of Christ

"The Reign of Christ"

“Jesus, remember me when you come into your kingdom.”

(Luke 23:42)November 13 - Are You All In?

“Are You All In?”

“For it is as if a man, going on a journey, summoned his slaves and entrusted his property to them;”

(Matthew 25:14)November 06 - Deep Roots

“They shall be like a tree planted by water, sending out its roots by the stream. It shall not fear when heat comes, and its leaves shall stay green; in the year of drought it is not anxious, and it does not cease to bear fruit.”

(Jeremiah 17:8)October 30 -Faith in a Seed

"Faith in a Seed"

“Listen! A sower went out to sow.”

-Mark 4:3October 23 -The Truth About Scripture

“The Truth About Scripture”

“All scripture is inspired by God and is useful for teaching, for reproof, for correction,

and for training in righteousness”

(2 Timothy 3:16)October 16 -The Truth About Sin

“The Truth About Sin”

“Oh, rebellious children, says the Lord, who carry out a plan, but not mine;

who make an alliance, but against my will, adding sin to sin;”

(Isaiah 30:1)October 09 -The Truth About Neighbors

“The Truth About Neighbors”

“But wanting to justify himself, he asked Jesus, ‘And who is my neighbor?’”

(Luke 10:29)October 02 -The Truth About Polarization

“He shall judge between many peoples, and shall arbitrate between strong nations far away; they shall beat their swords into plowshares, and their spears into pruning hooks; nation shall not lift up sword against nation, neither shall they learn war any more;”

- Micah 4:3September 25 -What is Truth?

"What is Truth?"

“Pilate asked him, ‘What is truth?’”

-John 18:38aSeptember 18 - On Mission Together

On Mission Together

Rev. Eugene Cho

President, Bread for the World

September 18, 2022September 11 - Speaking the Truth in Love

“Speaking the Truth in Love”

“But speaking the truth in love, we must grow up in every way into him who is the head, into Christ,”

(Ephesians 4:15)God’s LinkedIn Profie

Rev. David A. Berry

Associate Pastor for Mission

September 04, 2022September 04 -God’s LinkedIn Profile

“God’s LinkedIn Profile”

“Where can I go from your spirit? Or where can I flee from your presence?”

(Psalm 139:7)August 28 - I Wish the Preacher - Will I Go to Heaven?

“And I heard a loud voice from the throne saying, ‘See, the home of God is among mortals. He will dwell with them; they will be his peoples, and God himself will be with them;’”

(Revelation 21:3)August 21 - I Wish the Preacher-Do We Need Church

“Do We Need the Church?”

“Now there are varieties of gift s, but the same Spirit;”

(1 Corinthians 12:4)“The Lord God Made Them All: A Green Theology”

Rev. Christopher A. Henry

Senior Pastor

August 14, 2022August 14 - The Lord God Made Them All: A Green Theology

“The Lord God Made Them All: A Green Theology”

“O Lord, our Sovereign, how majestic is your name in all the earth!”

(Psalm 8:9)August 7 - Faithful Families in a Crazy Busy Culture

“Faithful Families in a Crazy Busy Culture”

“After saying farewell to them, he went up on the mountain to pray.”

(Mark 6:46)July 31 - Mother, Sister, Daughter

“When the child grew up, she brought him to Pharaoh’s daughter, and she took him as her son. She named him Moses, ‘because,’ she said, ‘I drew him out of the water.’”

(Exodus 2:10)July 24 - Jeremiah

“Jeremiah”

“Then I said, ‘Ah, Lord God! Truly I do not know how to speak, for I am only a boy.’”

(Jeremiah 1:6)July 17 - Deborah

“Deborah”

“At that time Deborah, a prophetess, wife of Lappidoth, was judging Israel.”

(Judges 4:4)July 10 - Gideon

“Gideon”

“Then the Lord said to Gideon, ‘With the three hundred that lapped I will deliver you,

and give the Midianites into your hand. Let all the others go to their homes.’”

(Judges 7:7)To Be Free

Rev. Christopher A. Henry

Senior Pastor

July 03, 2022July 3 - To Be Free

“To Be Free”

“For freedom Christ has set us free. Stand firm, therefore, and do not submit again to a yoke of slavery.”

(Galatians 5:1)June 26 - Shiphrah and Puah

“Shiphrah and Puah”

“But the midwives feared God; they did not do as the king of Egypt commanded them, but they let the boys live.”

(Exodus 1:17)June 19 - Joseph and His Brothers

“They said to one another, ‘Here comes this dreamer. Come now, let us kill him and throw him into one of the pits; then we shall say that a wild animal has devoured him, and we shall see what will become of his dreams.’”

(Genesis 37:19-20)The Lord Came Down

Rev. Gracie H. Payne

Director of Young Adult Engagement

June 12, 2022June 12 - The Lord Came Down

“The Lord Came Down”

“The Lord came down to see the city and the tower, which mortals had built.”

(Genesis 11:5)A Sending Spirit

Rev. Madison M. VanVeelen

Associate Pastor of Care

June 5, 2022June 5 - A Sending Spirit

“A Sending Spirit”

“In the last days it will be, God declares, that I will pour out my Spirit upon all flesh…”

(Acts 2:17)If Tomorrow Comes

Rev. Christopher A. Henry

Senior Pastor

May 29, 2022May 29 - If Tomorrow Comes

“If Tomorrow Comes”

“So when they had come together, they asked him,

'Lord, is this the time when you will restore the kingdom to Israel?'”

(Acts 1:6)May 22 - A New Song

“A New Song”

“O sing to the Lord a new song; sing to the Lord, all the earth.”

(Psalm 96:1)May 15 - A Sending Church

“A Sending Church”

"And remember, I am with you always, to the end of the age."

(Matthew 28:20)May 8 - An Equipping Church

“An Equipping Church”

"He said to him, 'You shall love the Lord your God with all your heart,

and with all your soul, and with all your mind.'"

(Matthew 22:37)May 1 - A Public Church

“A Public Church”

"But seek the welfare of the city where I have sent you into exile, and pray to the Lord on its behalf,

for in its welfare you will find your welfare."

(Jeremiah 29:7)April 24 - Easter...Again

“Easter…Again!”

"Jesus said to him, 'Have you believed because you have seen me?

Blessed are those who have not seen and yet have come to believe.'"

(John 20:29)April 17 - Easter Changes Everything

“Easter Changes Everything”

"And suddenly there was a great earthquake; for an angel of the Lord, descending from heaven,

came and rolled back the stone and sat on it."

(Matthew 28:2)April 10 - Stones that Shout

“Stones that Shout”

"He answered, 'I tell you, if these were silent, the stones would shout out.'"

(Luke 19:40)April 03 - Table Manners

“Table Manners”

"In the temple he found people selling cattle, sheep, and doves, and the money-changers seated at their tables."

( John 2:14)March 27 - A New Pair of Shoes

“A New Pair of Shoes”

"Then the father said to him, ‘Son, you are always with me, and all that is mine is yours.'"

(Luke 15:31)March 20 -Two Copper coins

“Two Copper Coins”

"He also saw a poor widow put in two small copper coins."

(Luke 21:2)March 13 - Cling to the Cross

“Cling to the Cross”

"For the message about the cross is foolishness to those who are perishing,

but to us who are being saved it is the power of God."

(1 Corinthians 1:18)March 06 - Daily Bread

“Daily Bread”

"Give us this day our daily bread."

(Matthew 6:11)Is This Anything

Rev. Sara A. Hayden

Director of Training

1001 New Worshipping Communities Movement of the

Presbyterian Church (USA)

February 27, 2022February 27 - Is This Anything

“Is This Anything?”

"Now about eight days after these sayings Jesus took with him Peter and John and James,

and went up on the mountain to pray."

(Luke 9:28)February 20 - God with Us

“God with Us”

"For, in fact, the kingdom of God is among you."

(Luke 17:21)February 13 - The Way to God

“The Way to God”

"Thomas said to him, 'Lord, we do not know where you are going. How can we know the way?'"

( John 14:5)February 06 - Who is Lord?

“Who is Lord?”

"Why do you call me ‘Lord, Lord,’ and do not do what I tell you?"

(Luke 6:46)January 30 - We Need A Savior

“We Need A Savior…”

"For the Son of Man came not to be served but to serve, and to give his life a ransom for many."

(Mark 10:45)January 23 - But the Teacher says...

“But the Teacher Says…”

"But I say to you, Love your enemies and pray for those who persecute you."

(Matthew 5:44)January 16 - What a Friend?

“What a Friend…”

"No one has greater love than this, to lay down one’s life for one’s friends."

( John 15:13)January 9 - A Starting Point

“A Starting Point”

"The beginning of the good news of Jesus Christ, the Son of God."

(Mark 1:1)January 2 - Led to Joy

“Led to Joy”

"When they saw that the star had stopped, they were overwhelmed with joy." (Matthew 2:10A Starting Point

Rev. Christopher A. Henry

Senior Pastor

January 9, 2022December 19 - An Invasion of Love

“An Invasion of Love”

"And the Word became flesh and lived among us, and we have seen his glory,

the glory as of a father’s only son, full of grace and truth."

( John 1:14)December 12 - A Brand New Song

"And Mary said, 'My soul magnifies the Lord, and my spirit rejoices in God my Savior, for he has looked with favor on the lowliness of his servant. Surely, from now on all generations will call me blessed; for the Mighty One has done great things for me, and holy is his name.'"

(Luke 1:46-49)December 5 - A Wilderness Voice

“A Wilderness Voice”

"And the crowds asked him, 'What then should we do?'"

(Luke 3:10)November 28 - A Vision of Hope

“A Vision of Hope”

"'Master, now you are dismissing your servant in peace, according to your word;'"

(Luke 2:29)November 21 - Kingdom Rehearsal

“Kingdom Rehearsal”

"Jesus answered, 'My kingdom is not from this world. If my kingdom were from this world, my followers would be

fighting to keep me from being handed over to the Jews. But as it is, my kingdom is not from here.'"

( John 18:36)November 14 - Eat This Book

“Eat this Book”

"So I opened my mouth, and he gave me the scroll to eat."

(Ezekiel 3:2)November 7 - The Eschatological Itch

“The Eschatological Itch: The Saga of a Roomy God”

"But, as it is written, 'What no eye has seen, nor ear heard, nor the human heart conceived,

what God has prepared for those who lOctober 31 -What is a Saint?

“What is a Saint?”

"...joyfully giving thanks to the Father, who has enabled you to share in the inheritance of the saints in the light."

(Colossians 1:12)October 24 -When in our Music god is glorified

“When in our Music God is Glorified”

"Then your light shall break forth like the dawn, and your healing shall spring up quickly;

your vindicator shall go before you, the glory of the Lord shall be your rear guard."

(Isaiah 58:8)October 17 - The Heart's Eyes

“The Heart’s Eyes”

"...so that, with the eyes of your heart enlightened, you may know what is the hope to which he has called you,

what are the riches of his glorious inheritance among the saints..."

(Ephesians 1:18)October 10 - Heart to Give

“From the Heart”

"For where your treasure is, there your heart will be also."

(Matthew 6:21)October 3 - An Invitation For You

“An Invitation for You”

"Then they told what had happened on the road,

and how he had been made known to them in the breaking of the bread."

(Luke 24:35)September 26 - Living Water

“Living Water”

"When you pass through the waters, I will be with you; and through the rivers, they shall not overwhelm you;

when you walk through fire you shall not be burned, and the flame shall not consume you."

(Isaiah 43:2)September 19 - God's House, Our Home

“God’s House, Our Home”

"Then the cloud covered the tent of meeting, and the glory of the Lord filled the tabernacle."

(Exodus 40:34)September 12 - Equipping the Saints- To Be Followers of the Way

“Equipping the Saints”

"...to equip the saints for the work of ministry, for building up the body of Christ..."

(Ephesians 4:12)The Genetic Make Up of Faith

Rev. Lex M. Allum

Lake Fellow in Parish Ministry

September 5, 2021September 5 - The Genetic Make Up of Faith

“The Genetic Make Up of Faith”

"Then Jesus answered her, 'Woman, great is your faith! Let it be done for you as you wish.'

And her daughter was healed instantly."

(Matthew 15:28)August 29 - Bring What You Have

“Bring What You Have”

"Taking the five loaves and the two fish, he looked up to heaven, and blessed and broke the loaves,

and gave them to his disciples to set before the people; and he divided the two fish among them all."

(Mark 6:41)August 22 - Discern the Spirit

“Discern the Spirit”

"Beloved, do not believe every spirit, but test the spirits to see whether they are from God; for many false prophets have gone out into the world."

(1 John 4:1)August 15 - Throw Parties

“Throw Parties”

"When he noticed how the guests chose the places of honor, he told them a parable."

(Luke 14:7)August 8 - Use Your Words

“Use Your Words”

"For we do not proclaim ourselves; we proclaim Jesus Christ as Lord and ourselves as your slaves for Jesus’ sake."

(2 Corinthians 4:5)August 1 - Companions for the Journey

“Companions for the Journey”

"Orpah kissed her mother-in-law, but Ruth clung to her"

(Ruth 1:14)

July 25 - Nothing for the Journey

“Nothing for the Journey”

"Go on your way. See, I am sending you out like lambs into the midst of wolves."

(Luke 10:3)July 18 - All God’s Children Need Traveling Shoes

“All God’s Children Need Traveling Shoes”

"They had journeyed from Rephidim, entered the wilderness of Sinai, and camped in the wilderness;

Israel camped there in front of the mountain."

(Exodus 19:2)July 11 - Despair, Absence, and Hope

“Despair, Absence, and Hope”

"Why are you cast down, O my soul, and why are you disquieted within me?

Hope in God; for I shall again praise him, my help and my God."

(Psalm 42:11)July 4 - Wonder

“Wonder”

"Let them praise the name of the Lord, for he commanded and they were created."

(Psalm 148:5)June 27 - Praise

“Praise”

"Let everything that breathes praise the Lord! Praise the Lord!"

(Psalm 150:6)June 20 - Light

“Light”

"The Lord is my light and my salvation; whom shall I fear?

The Lord is the stronghold of my life; of whom shall I be afraid?"

(Psalm 27:1)June 6 - The Danger of Friendship

June 13 - Lament

"How long must I bear pain in my soul, and have sorrow in my heart all day long? How long shall my enemy be exalted over me?"

(Psalm 13:2)The Danger of Friendship

Reverend Chris Palmer

Lake Fellow in Parish Ministry

June 6, 2021

May 23 - Life in the Spirit: I Believe in the Holy Spirit

May 30 - The With-ness of God

The With-ness of God

Reverend Gracie H. Payne

Lake Fellow in Parish Ministry

May 30, 2021

May 16 - Life in the Spirit: Looking Around

May 9 - Life in the Spirit: Awakening

May 2 - Life in the Spirit: The Power of Testimony

April 25 - Life in the Spirit: Plenty Good Room

April 18 - Life in the Spirit: Practicing Resurrection

April 11

Love and Child's PlayLove and Child's Play

Reverend Christopher A. Palmer

Lake Fellow in Parish Ministry

April 11, 2021

April 4 - Easter

Let God InLetting God In

Reverend Christopher A. Henry

Senior Pastor

April 4, 2021 - Easter Sunday

March 28 - Lenten Series

ReLent Series - A Season for Letting Go-DoubtMarch 14 - Lenten Series

ReLent Series - A Season for Letting Go-JudgementMarch 7 - Lenten Series

ReLent Series - A Season for Letting Go-IdolsFebruary 28 - Lenten Series

ReLent Series - A Season for Letting Go-ShameTransfigurtion Sunday

Reverend Christopher A. Henry & Rev. Dr. Winterbourne

February 14, 2021

February 21 - Lenten Series Sunday

ReLent Series - A Season for Letting Go-ControlFebruary 14 - Transfiguration Sunday

Transfiguration SundayFebruary 7, 2021 Fifth Sunday after Epiphany

Week 5 in a Sermon Series - Back to BasicsJanuary 31, 2021 Fourth Sunday after Epiphany

Week 4 in a Sermon Series - Back to BasicsJanuary 24, 2021 Third Sunday after Epiphany

Week 3 in a Sermon Series - Back to BasicsJanuary 17, 2021 Second Sunday after Epiphany

Week 2 in a Sermon Series - Back to BasicsJanuary 10, 2021 Baptism of the Lord

Week 1 in a Sermon Series - Back to BasicsA Word to Seekers

January 3, 2021

Reverend Christopher A. Henry

Senior PastorJanuary 3, 2021 Epiphany Sunday

The Light of Salvation

December 27, 2020

Reverend Michael M. Samson

Associate Pastor for EngagementDecember 27, 2020 First Sunday after Christmas

December 20, 2020 Fourth Sunday of Advent

Week 4 in a Sermon Series - Who is this MessiahDecember 13, 2020 Third Sunday of Advent

Week 3 in a Sermon Series - Who is This Messiah?December 6, 2020 Second Sunday of Advent

Week 2 in a Sermon Series - Who is This Messiah?November 29, 2020 First Sunday of Advent

Week 1 in a Sermon Series -- Who is This Messiah?When Did We See You?

November 22, 2020

Reverend Christopher A. Henry

Senior PastorNovember 22, 2020 Twenty Fifth Sunday after Pentecost

Week 3 in a Sermon Series - Can We Be Reconciled?November 15, 2020 Twenty Fourth Sunday after Pentecost

Week 2 in a Sermon Series - Can We Be Reconciled?November 8, 2020 Twenty Third Sunday after Pentecost

Week 1 in a Sermon Series - Can We Be Reconciled?What We Leave Behind

November 1, 2020

Reverend Christopher A. Henry

Senior PastorNovember 1, 2020 Twenty Second Sunday after Pentecost

The full service starts with video 2 on the playlistOctober 25, 2020 Twenty First Sunday after Pentecost

Week 3 in a Sermon Series - Begin, AgainOctober 18, 2020 Twentieth Sunday after Pentecost

Week 2 in a Sermon Series - Begin, AgainOctober 11, 2020 Nineteenth Sunday after Pentecost

Week 1 in a Sermon Series - Begin, AgainGod's Abundance

October 04, 2020

Reverend Christopher A. Henry

Senior PastorOctober 4, 2020 Eighteenth Sunday after Pentecost

September 27, 2020 Seventeenth Sunday after Pentecost

Week 3 in a Sermon Series - Faithful PoliticsSeptember 20, 2020 Sixteenth Sunday after Pentecost

Week 2 in a Sermon Series - Faithful PoliticsSeptember 13, 2020 Fifteenth Sunday after Pentecost

Week 1 in a Sermon Series - Faithful Politics“Arise and Come Away”

September 06, 2020

Reverend Gracie H. Payne

Lake Fellow in Parish MinistrySeptember 6, 2020 Fourteenth Sunday after Pentecost

August 30, 2020 Thirteenth Sunday after Pentecost

Week 4 in a Sermon Series - Going DeepAugust 23. 2020 Twelfth Sunday after Pentecost

Week 3 in a Sermon Series - Going DeepAugust 16. 2020 Eleventh Sunday after Pentecost

Week 2 in a Sermon Series - Going DeepAugust 9, 2020 - Tenth Sunday after Pentecost

Week 1 in a Sermon Series - Going Deep August 02, 2020 - Ninth Sunday after Pentecost

Week 7 in a Sermon Series - Childhood Bible StoriesJuly 26, 2020 Eighth Sunday after Pentecost

Week 6 in a Sermon Series - Childhood Bible StoriesJuly 19, 2020 - Seventh Sunday after Pentecost

Week 5 in a Sermon Series - Childhood Bible StoriesJuly 12, 2020 – Sixth Sunday after Pentecost

Week 4 in a Sermon Series - Childhood Bible StoriesJuly 5, 2020 - Fifth Sunday after Pentecost

Week 3 in a Sermon Series - Childhood Bible Stories

The full services starts with Video 3 on the playlistJune 28, 2020 - Fourth Sunday after Pentecost

Week 2 in a Sermon Series - Childhood Bible StoriesJune 21, 2020 - Third Sunday after Pentecost

Week 1 in a Sermon Series - Childhood Bible StoriesChoose to Love

June 14, 2020

Rev. Karen Lang

Senior Associate Pastor for Congregational LifeJune 14, 2020 - Second Sunday after Pentecost

June 7, 2020 - Trinity Sunday

Listening in Lament

June 7, 2020

Rev. Christopher A. Henry

Senior PastorMay 31, 2020 - Pentecost Sunday

May 24. 2020 - Seventh Sunday of Easter

The full service starts with video 2 on playlistMay 17th, Sixth Sunday of Easter

The full service starts with video 2 on playlist

Missing Easter

April 12, 2020

Reverend Christopher A. Henry

Senior Pastor Resurrection in the Plural

April 19, 2020

Reverend Christopher A. Henry

Senior PastorMay 10, 2020 Fifth Sunday of Easter

Mother's DayMay 3, 2020 _ Fourth Sunday of Easter

The full service starts with Video 2 on playlistThe Never-Ending Story

April 26, 2020

Reverend Christopher A. Henry

Senior PastorApril 26, 2020 - Third Sunday of Easter

April 19, 2020 – Second Sunday of Easter

The full service starts with video 2 on playlistApril 12, Easter Sunday

The full service starts with video 3 on playlist. April 5, 2020 - Palm Sunday

Week 6 in Lenten Sermon Series - A Clearing SeasonMarch 29, 2020 – Fifth Sunday in Lent

Week 5 in a Lenten Sermon Series - A Clearing SeasonMarch 22, 2020 - Fourth Sunday in Lent

Week 4 in a Lenten Sermon Series - A Clearing SeasonMarch 15, 2020 – Third Sunday in Lent

Week 3 in a Lenten Sermon Series - A Clearing SeasonMarch 8, 2020 – Second Sunday in Lent

Week 2 in a Lenten Sermon Series - A Clearing SeasonMarch 1, 2020 – First Sunday in Lent

Week 1 in a Lenten Sermon Series - A Clearing SeasonDecember 30, 2018 – First Sunday After Christmas

December 9, 2018 – Second Sunday of Advent

Week 2 in a Sermon Series - Change Your ChristmasDecember 2, 2018 – First Sunday of Advent

Week 1 in a Sermon Series - Change Your Christmas